Browse Your Way to Success with Hard Money Georgia Solutions

Browse Your Way to Success with Hard Money Georgia Solutions

Blog Article

The Advantages of Selecting a Hard Cash Funding Over Typical Funding Options

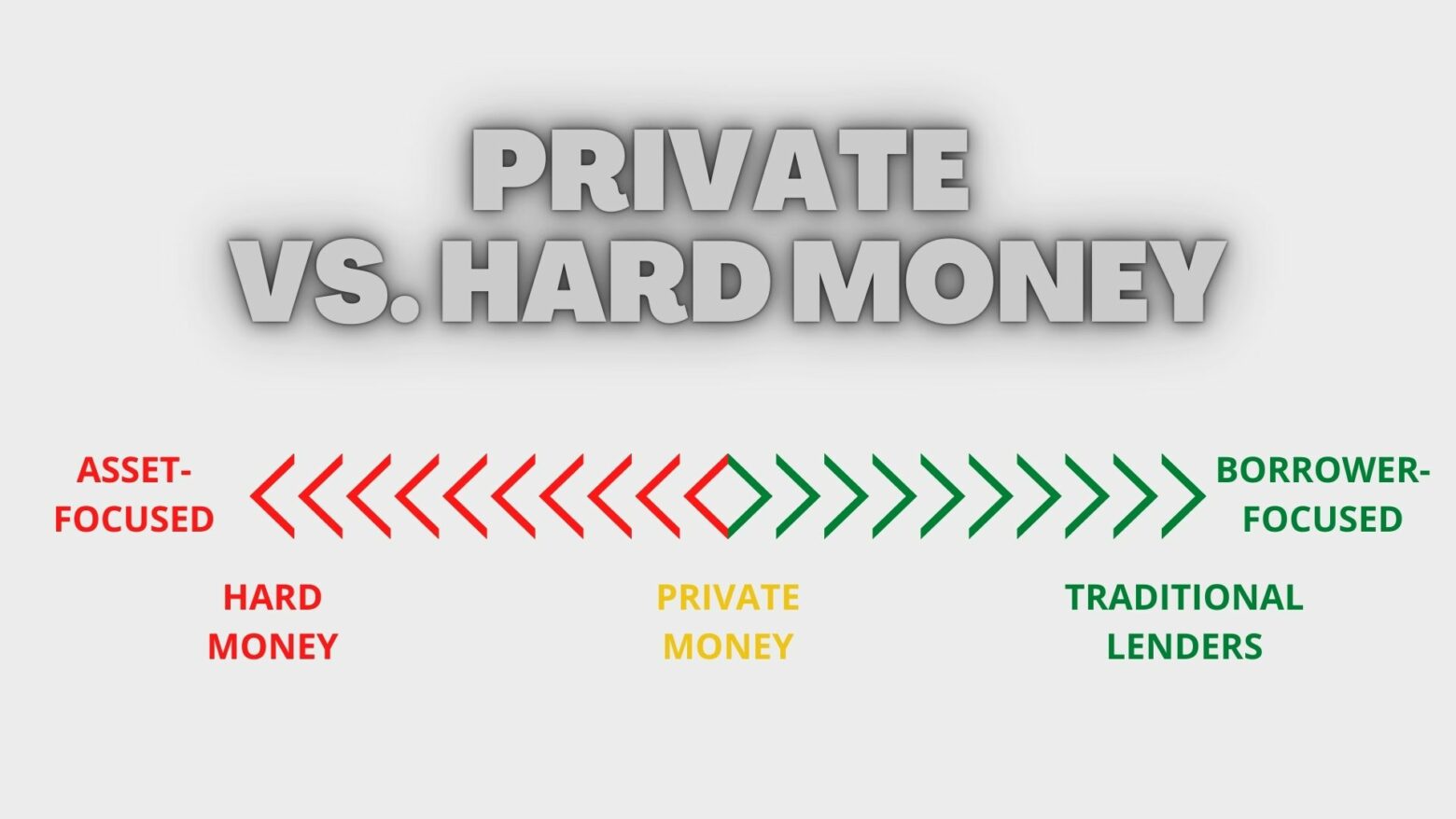

In the realm of actual estate funding, hard money fundings offer an engaging alternative to traditional alternatives, particularly for financiers seeking swift access to funding. Notably, these lendings promote quicker approval processes and embrace an extra lenient strategy to borrower credentials, stressing property worth over credit report background.

Faster Access to Funding

Securing funding rapidly is a crucial benefit of difficult cash fundings. Unlike standard funding alternatives, which usually entail extensive approval processes and comprehensive documentation, difficult money lendings provide expedited accessibility to resources. This is particularly useful for actual estate financiers and programmers that require immediate financing to seize chances in an open market.

Typically, difficult cash lenders focus on the value of the residential property being funded as opposed to the consumer's creditworthiness. Because of this, these lendings can be accepted in a matter of days as opposed to months or weeks. The structured procedure enables borrowers to relocate swiftly on property procurements, improvements, or other urgent economic demands.

Furthermore, tough cash car loans are frequently structured to fit different project timelines, allowing consumers to get funds when they need them most. This rate is important in property deals, where market problems can alter swiftly, and the ability to act promptly can imply the difference in between protecting a profitable bargain or shedding it to an additional customer.

Adaptable Qualification Standards

Difficult money lendings are defined by their adaptable credentials standards, making them an appealing option for a diverse variety of consumers. Unlike standard financing, which usually calls for rigid credit score checks and considerable documentation, hard money loan providers focus mainly on the worth of the security, normally genuine estate. This indicates that customers with less-than-perfect credit rating or limited financial history can still secure financing, as the asset itself functions as the main assurance for the loan.

This flexibility opens up doors for different individuals, consisting of investor, entrepreneurs, and those in urgent demand of resources. Borrowers facing monetary obstacles, such as recent insolvencies or foreclosures, may find tough money finances to be a viable option when traditional lending institutions refuse to prolong credit history. The requirements can vary dramatically among different lenders, enabling consumers to bargain terms that finest fit their certain situations.

Ultimately, the versatile nature of credentials standards in difficult cash lending not just facilitates quicker accessibility to funds however also encourages debtors to make use of possibilities that might otherwise be out of reach. This aspect highlights the charm of hard money fundings in today's vibrant economic landscape.

Shorter Financing Approval Times

Among the remarkable advantages of tough money car loans is their considerably shorter approval times compared to typical financing methods. While standard loan providers may take weeks or perhaps months to refine a loan application, difficult money loan providers generally expedite their authorization procedure - hard money georgia. This efficiency is especially advantageous genuine estate financiers and property purchasers that need prompt accessibility to funds

The rapid approval timeline is mostly because of the truth that hard cash fundings focus primarily on the worth of the security instead of the borrower's credit reliability. This permits lenders to make fast evaluations based upon residential property assessments, thus getting rid of extensive underwriting treatments typical in traditional financing. As a result, customers can frequently receive financing within a matter of days, allowing them to act promptly in competitive realty markets.

This speed is critical for financiers aiming to take time-sensitive chances, such as distressed buildings or public auctions, where delays can mean losing an offer. By picking a hard cash loan, borrowers can browse the market much more successfully, allowing them to safeguard residential or commercial properties prior to others have the possibility to act. The rapid access blog to funding can be a game-changer for those in need of a timely financial option.

Less Paperwork and Documentation

The structured authorization process of hard money finances is enhanced by a considerable reduction in documentation and documents requirements. Unlike standard financing, which frequently demands considerable documentation such as earnings confirmation, credit scores histories, and in-depth monetary declarations, tough cash loans prioritize simpleness and performance. This decrease in documents enables customers to concentrate on securing financing instead than browsing through a maze of approvals and forms.

Tough cash loan providers normally put more focus on the worth of the collateral rather than the consumer's monetary background. Because of this, the documents needed usually consists of only the home evaluation, evidence of ownership, and some important source basic recognition. This shift not just speeds up the authorization procedure however also relieves the anxiety related to celebration considerable paperwork.

Moreover, the marginal paperwork entailed makes hard cash fundings specifically appealing genuine estate financiers and designers who might need to act swiftly on profitable possibilities (hard money georgia). By getting rid of the worry of extreme paperwork, tough money financings allow consumers to protect financing with greater agility, enabling them to concentrate on their financial investment goals as opposed to getting bogged down in management hurdles. This structured technique considerably boosts the borrowing experience

Investment Opportunities With Less Competitors

Financial investment opportunities in genuine estate often manifest in atmospheres where competitors is restricted, enabling wise investors to profit from special bargains. Difficult cash lendings supply a critical advantage in such circumstances. Unlike standard financing, which can be bogged down by rigid needs and extensive authorizations, hard money fundings use rapid access to funding, allowing investors to act quickly.

In markets identified by less competitors, properties may be underestimated or neglected by conventional buyers. This presents an opportunity for investors to protect reduced acquisition rates and boost their returns. With difficult money fundings, financiers can rapidly get these residential or commercial properties, apply required restorations, and subsequently raise their market price.

Furthermore, the adaptability of hard cash offering permits creative financing remedies that conventional loan providers may not entertain, better lowering competition for desirable properties. Financiers look at this website can leverage their proficiency and market expertise, placing themselves to take opportunities that might miss. Eventually, the dexterity and responsiveness managed by difficult money finances encourage capitalists to navigate much less competitive landscapes successfully, turning possible risks right into financially rewarding incentives.

Verdict

Finally, difficult money finances existing substantial advantages over standard financing options, especially in regards to expedited access to funding and more versatile credentials criteria. The shorter funding approval times and very little documentation required boost the ability to act swiftly on financial investment opportunities. These characteristics enable borrowers to navigate competitive actual estate markets successfully, enabling for the acquisition of underestimated homes with lowered competition. Thus, difficult money financings offer as a valuable monetary tool for financiers looking for easily accessible and quick funding services.

Difficult cash lendings are characterized by their versatile credentials criteria, making them an eye-catching option for a diverse range of borrowers. Consumers facing economic obstacles, such as current bankruptcies or repossessions, may find difficult money fundings to be a practical solution when traditional lenders reject to prolong credit rating.The rapid approval timeline is mainly due to the fact that tough money loans concentrate largely on the worth of the collateral rather than the borrower's creditworthiness. By picking a difficult money loan, debtors can navigate the market a lot more properly, permitting them to safeguard homes prior to others have the chance to act. By getting rid of the burden of extreme paperwork, difficult cash loans make it possible for debtors to secure financing with better dexterity, permitting them to concentrate on their financial investment goals instead than obtaining bogged down in management obstacles.

Report this page